In a bit of a departure from our normal sort of post (what is normal, anyway, for the House of Gjertsen?), I would like to welcome visitors from analystforum.com—strange folks, who, like me, are spending a perfectly gorgeous spring trying to fill their brains and retain enough facts about global asset management to take their last CFA exam this June.

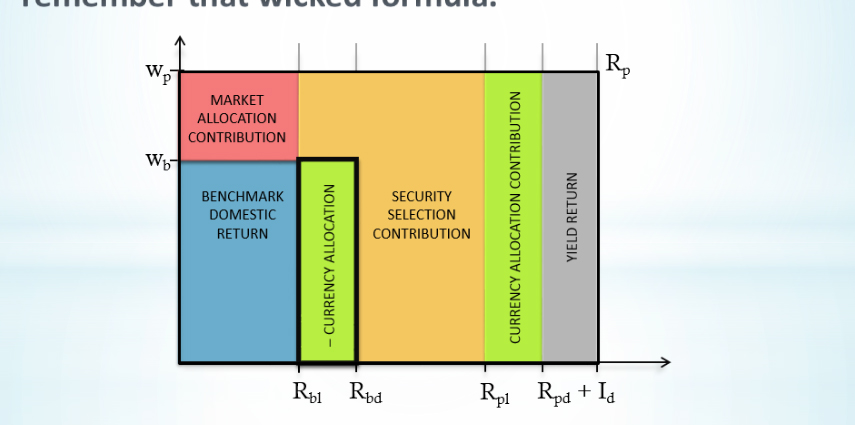

The rest of you non-CFA types are welcome to follow along. The topic at hand has to do with if a global portfolio manger outperformed (or underperfomed) a benchmark, what was the cause of the outperformance (or underperformance)? Was it primarily about stock picking in certain countries? Or the overweighting of certain countries’ markets? Or the movement of foreign currencies? All things which are awesome to know, right?

Well anyway, here’s a glimpse into my professional life. Unfortunately, due to Microsoft’s buggy but cutting-edge SkyDrive technology, the animations in the slideshow do not work correctly unless you:

- view full-size presentation (bottom-right corner, below), and then (important)

- click on “Start Slide Show” at the top of the window that opens.

4/20 UPDATE: Here’s another graphical explanation for CFA Level 3, this one addressing multi-period attribution. Follow the same instructions as above:

Okay, I *think* I managed to follow that… there’s a reason I studied biology in college! 😛 Oh, and I loved your little comment at the end. Way to go, kiddo! 🙂

Thanks so much for posting this. After going through it a few times I’ve finally gotten this as well as the micro performance attribution formula and implementation formula down for good.

I’m a very visual learner so this helped a lot. Do you have any other tricks like this for the curriculum?

No more slideshows I’m afraid, although if I should have the displeasure of having to study this curriculum next year, I’ll probably come up with a few more to help myself learn the material. Glad it helped.

DELIGHTFUL easter egg on last slide…a picture of your kiddo with a note that says “my 19 mo. old learned how to count to six while I built this spreadsheet” puts the whole study push into perspective. Thanks for sharing!!!!

Your diagram helps immensely. I think there is room to clarify further with terminology here…

“DECOMPOSITION” needs no benchmark, it takes a portfolio return and chops it into “COMPONENTS” . A clean example of this is formula (4) on page 209.

“ATTRIBUTION” on the other hand needs benchmark and chops up the differential return (the value added return) into “CONTRIBUTIONS” A clean example of this is formula (16) on page 162.

The big formula (5) on page 211 combines COMPONENTS and CONTRIBUTIONS (i.e. DECOMPOSITION and ATTRIBUTION)…not sure why they do this mixed treatment. This to me was very confusing.

Also the CFAI examples ask to DECOMPOSE into Cap. gain, yield, and currency “COMPONENTS” unfortunately the EOC pollute the vocabulary.

I think there is value in keeping the vocabulary clear, to know exactly what is being discussed.

Thanks for the encouragement, and you’re very right regarding attribution vs. decomposition. I understood that distinction better after I built the slideshows. The thing to keep clear is that in an attribution, all the terms besides the benchmark return can still be thought of as a decomposition. I doubt the terminology will be that big of an issue on the exam, but who knows.

In case of Calculating the Performance Attribution how can we do it for multi period if the weight is known on daily basis.

That’s a good subject for discussion over at http://www.analystforum.com, but my first reaction is that it doesn’t matter what “periods” the attribution is using in terms of the formulas. In your case you would be attributing daily performance. I shudder a little bit as a portfolio manager to think what kinds of decisions are made on the basis of daily performance attribution. You could take a weighted averages and do a calculation over a longer period.

Hi John

Had a small favor to ask. I know you had published the “Sector-Allocation” Attribution model graph someplace – but later it got overwritten by the “Global attribution” one.

Would you know if you had a copy someplace and could send the same to me?

Thanks

C.P.Krishnan (cpk123 on AF).

Honestly, I’m not sure what you’re talking about; I’m pretty sure these two were the only Powerpoint presentations I’ve ever built. Maybe you can refresh my memory on what the formula is, or else point me to a thread on AF where I refer to the one you’re talking about. I know you can take the second one (Multi-period performance attribution) and read “market allocation” as “sector allocation” instead of “country allocation”, but I doubt that’s what you’re referring to.